Our the time financing specialist will be your publication on entire procedure

It less common choice is called property tax deferral programs and you will deferred payment funds. Like other reverse mortgage loans, they arrive in order to property owners who will be at the very least 62 age dated. Although not, these opposite mortgages are only able to be studied to own a particular goal approved by the financial, which is normally a property improvement endeavor.

Nevada Reverse Home loan Borrower Liberties

Vegas residents have the same defenses the new FHA and you will HUD provide to opposite home loan individuals. These are typically the right to live in the second:

- Remain in your house. Contrary mortgage consumers feel the to stay static in the house as long as they meet with the loan personal debt, and keeping our home, paying the possessions fees, make payment on home insurance, and you may residing in the house every seasons.

- No prepayment punishment. Reverse financial individuals don’t need to wait until it sell the house to start using they back. Capable initiate repaying the mortgage when instead up against prepayment penalties.

- Counseling. All contrary mortgage consumers have to complete a sessions class with a good HUD-approved third-group therapist. While this is a necessity, it’s also a protection as the mission is to try to make sure your completely understand just what an other mortgage is actually and just how they actively works to build an informed decision.

- Non-recourse loans. One of the biggest defenses having reverse financial consumers would be the fact they are non-recourse finance. As a result in the event your loan harmony exceeds the value of your residence, you or your heirs won’t be guilty of paying back the real difference.

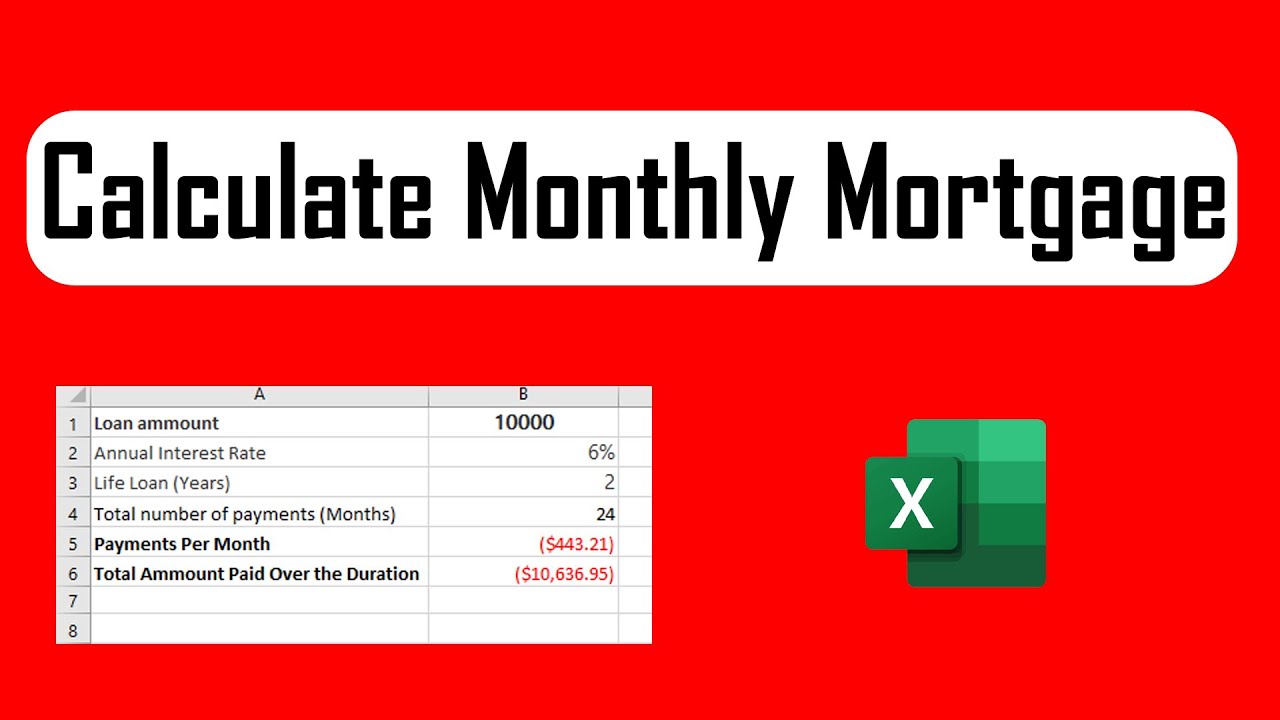

Las vegas, nevada Reverse Home loan Calculator

If you’re contemplating taking a contrary home loan and require to learn how much cash you are in a position to qualify for, take a look at all of our opposite mortgage calculator.

That it unit can provide an offer out of how much cash your could probably acquire centered on your age, the value of your house, and people established mortgage loans or liens on your property.

Las vegas, nevada Opposite Financial Application Procedure

Listed here is a basic report on the opposite home loan application processes any time you so you’re able to go ahead that have Mutual from Omaha Mortgage for the Nevada:

Step one: Totally free Appointment

The opposite mortgage excursion starts with an appointment that have one of all of our educated opposite home loan advisers, who will become familiar with your individual points, promote financing imagine, and you may address any questions otherwise issues.

Step two: Counseling Concept

Once the consultation, the federal government necessitates that you sit-in a sessions class conducted from the good HUD-recognized third-cluster counselor. The aim will be to inform you about contrary mortgage loans, its provides, Visit Website appropriateness to suit your problem, in order to mention choices. You will get a certificate upon completion, and therefore should be submitted to the coach so you’re able to officially initiate the new reverse home loan software.

Step three: App Entry

On the counseling certification at your fingertips, your contrary home loan advisor will help you to complete the program in addition to the required paperwork. This will become suggestions such as for instance a photo ID, their homeowner’s insurance policy, plus current possessions goverment tax bill. Event these types of records at this time can assist expedite the loan techniques.

Step four: Appraisal and other Paperwork

Once your application is submitted, Mutual from Omaha Financial usually fee a home appraisal to determine your property’s standing and market value, which will help dictate the fresh eligible loan amount. Moreover, we will and procure a title and credit report to check on when it comes down to liens and you may consider debt balances. This step essentially takes 1 to 2 months.

Action 5: Operating and Underwriting

Just after entry the application and files, all of us kickstarts this new instructions underwriting procedure. Brand new underwriter checks if the all the reverse mortgage prerequisites are fulfilled and you will identifies to your mortgage recognition. Either, they may search more paperwork otherwise household solutions ahead of finalizing the fresh new loan. The reverse real estate loan mentor will keep your current regarding entire process.

- Онлайн казино Ирвин. Зеркало казино Irwin. Личный кабинет, регистрация, игровые автоматы

- Играть Бесплатно В Misery Mining На Аркада Казино

- Банда казино играть на деньги! Мобильная версия доступна уже!

- Банда казино регистрация

- Онлайн-казино Онлайн-слоты Онлайн https://vinilmoscow.ru/ без пластины Бесплатно

- As the design funds are incredibly versatile, capable feature high qualifying standards

- Omelge: Welche Alternativen Gibt Es?

- All of our calculator is reason behind monthly, yearly, otherwise you to-day more money

- What is the Difference between FHA and you will Conventional Mortgage brokers?