Budget develops basic homebuyers deposit loan design what are the dangers?

This new federal government’s earliest home loan deposit strategy will assist the individuals who be considered, however, at the cost of people that dont, writes UNSW Sydney’s Nigel Stapledon

With construction value set to end up being an option election topic, the 2022 federal budget develops brand new strategy the latest Coalition put forward Minnesota personal loans from the 2019 election to help first homebuyers.

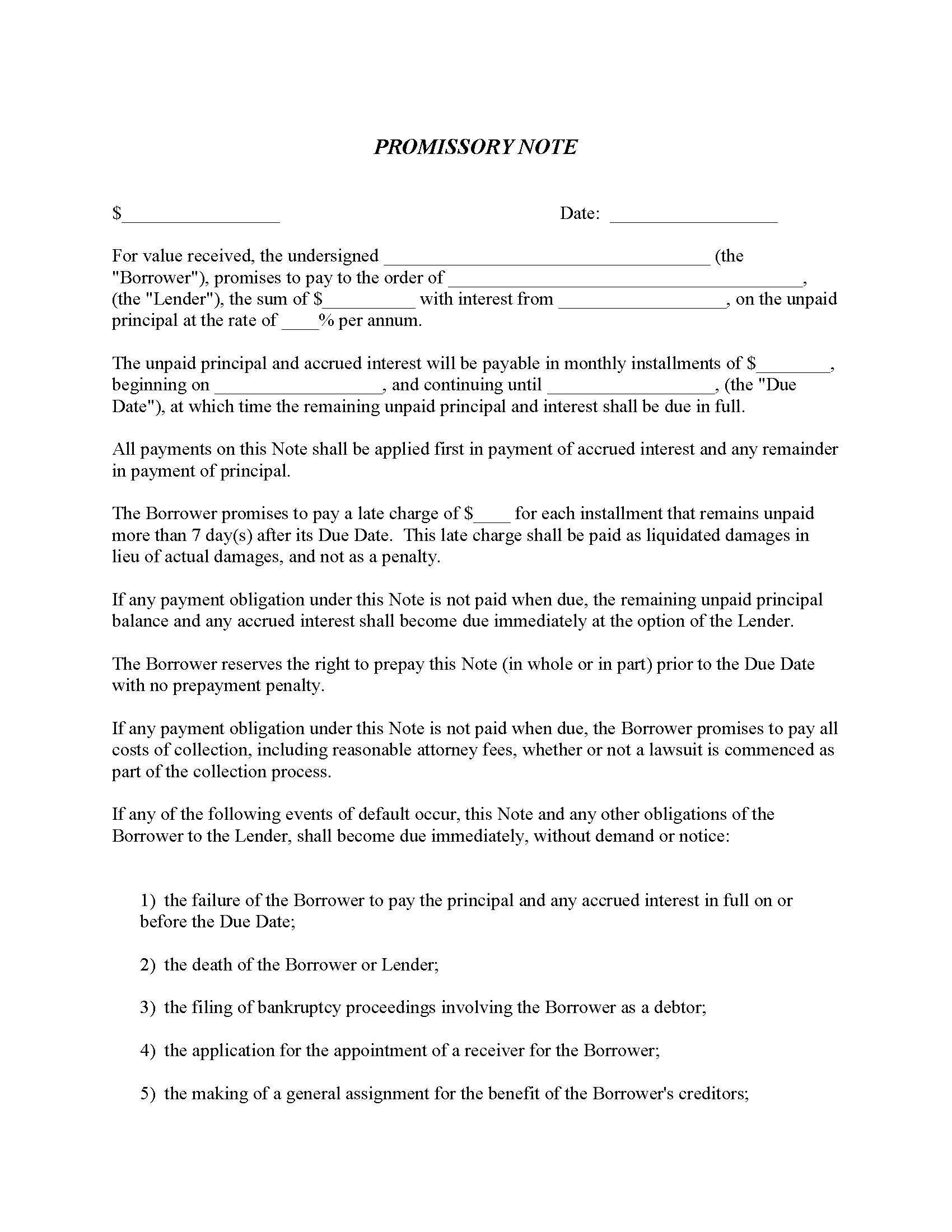

The original Mortgage Put Design helps those people without any fundamental 20 percent deposit necessary for mortgage brokers. For those who meet the requirements, it promises as much as 15 percent regarding a great loan’s really worth, definition customers normally safer a home loan with a good 5 for every single cent deposit.

From the 2021-twenty two monetary year the brand new design was capped in the ten,000 urban centers. This new 2022 budget is actually expanding so it to help you thirty-five,000 annually, also an extra ten,000 metropolitan areas to possess earliest homebuyers within the regional section. It is going to develop a class to own unmarried moms and dads brought into the the latest 2021 funds, enabling particular to get in which have a two per cent put, raising the cover in order to 5,000 a year.

Bodies software to simply help basic homebuyers was routinely criticised given that just placing up pressure towards cost, taking no real advantage to basic home buyers. Which design usually push up rates, however by the exact same matter just like the worth of the newest assistance.

You to risk of the Very first Financial Deposit Plan is this forcibly forces up home pricing, leading them to unaffordable for other people. Image: Shutterstock

What is actually operating up property cost

Australia’s relatively higher homes costs can usually become attributed to the fresh extreme income tax advantages for property possession and you can rigidities for the also provide front, for example zoning or other regulating constraints. Previously 2 yrs, such circumstances was formulated because of the potent blend of COVID-19 and you can low interest.

This has been a major international phenomenon, certainly not book to Australian continent. The functional-from-house trend triggered a surge in demand to possess big home and you will a change in order to outlying and you will local portion at the same time because the central finance companies pressed specialized rates alongside zero in order to trigger a deep failing economic climates.

A second-best bet

New put make certain plan to help earliest home buyers is what economists call an extra-best bet. A maximum solution manage far more in person target the new consult and offer grounds driving upwards costs. In place of this, this new government’s package should be to provide basic-homebuyers a boost more anybody else.

People problem instance a plan simply increases all the vessels and you will sets upward pressure into rates is not some proper. It can push-up cost, although not because of the same count because the value of the newest mortgage claims. To achieve that the buyers will have to obtain the same concession, so there needed to be no impact on the production of households. Supply throughout the housing industry tends to be sluggish to reply but it can change with consult.

For the past a couple of years, very first home buyers are making upwards regarding the 20 percent off the buyers. This strategy, even with the expanded cover, may benefit less than half one number on the eight percent of all of the people.

So the scheme gets specific affect property rates, but not sufficient to offset the property value the assistance to help you men and women buyers who be considered. At the same time, those trading belongings pays marginally significantly more. So tend to investors, and you can tenants inside due direction.

The big concern about the newest deposit system ‘s the chance you to definitely those using it to find a house may then enter into financial issues and default on their financial. Image: Shutterstock

Greater influence, higher risk

The big fear of this system is the chance the individuals using it buying property can then enter into monetary difficulties and you may standard on the financial.

It was a contributing cause for the usa subprime mortgage crisis that contributed to the global economic crisis from 2007-08. Policies built to rating lowest-income houses into the sector did actually works before the drama hit. Then domestic costs tumbled and lots of have been obligated to promote during the large losings.

Once you influence upwards, borrowing 95 per cent otherwise 98 per cent of the really worth out-of a home, youre significantly more started if the cost slide. Even a small decline could over get rid of the security.

Homes isnt risk-totally free. Time issues. House cost can also be fall and rise. Having interest levels growing and you can huge global financial uncertainty, particular negative effects using this design down the song can not be ruled-out.

Nigel Stapledon are a report Fellow into the A residential property from the Middle to possess Applied Economic Look, UNSW Questionnaire. A form of this informative article checked towards the Talk.

You’re able to republish this information each other online and inside the printing. We query that you follow some simple assistance.

Please dont edit this new section, make sure to trait mcdougal, the institute, and you will speak about that article try to start with had written with the Organization Envision.

- Онлайн казино Ирвин. Зеркало казино Irwin. Личный кабинет, регистрация, игровые автоматы

- Играть Бесплатно В Misery Mining На Аркада Казино

- Банда казино играть на деньги! Мобильная версия доступна уже!

- Банда казино регистрация

- I would reckon that much time messages regarding the internet dating context is actually daunting

- Игорное казино Вулкан зеркало заведение Онлайн Пробные Видео покерные автоматы Бесплатно

- Что вы должны иметь в Азино 777 официальный сайт виду, играя в онлайн-казино Видеопокерные автоматы В Интернете

- Credit quality remains important just like the Bank adheres to its strict underwriting criteria

- Vay Vốn Nhanh Cùng app vdong ios Bác Sĩ Đông