Inside next one-fourth out of 2021, new Federal Reserve Financial away from St

Very own Up Staff

Very own Up is actually a physically stored, Boston-founded fintech startup that is on a mission to make certain all family visitors receives a good bargain to their financial because of the for any reason strengthening people with designed studies, customized suggestions, and you can unprecedented access to mortgage brokers which will make most readily useful financial consequences and make clear the home capital sense.

Louis stated that the fresh new delinquency speed on the mortgages to possess just one-house is 2.49%. This is simply not loads, however for lenders, the quantity at stake try highest once the property owners normally pay hundreds regarding thousands of dollars getting a property or condominium. Knowing the borrower pays straight back the mortgage is critical.

Millennials make up the biggest show from home buyers on 37% and are generally also disproportionally earliest-go out homeowners. To possess younger millennials age 21 so you can 28, 86% try very first time homeowners and for earlier millennials ages 30 in order to 38, 52% try first-time homebuyers. Lenders need a work confirmation way to make certain these individuals, and all anyone else, have the earnings to blow straight back a mortgage that can most likely become their biggest monthly bill.

A main answer to accomplish that has been a job confirmation, that is a routine financial requisite. A career confirmation involves paperwork also paystubs, tax returns, W2s and you can choice different confirmation such an authored Verification out-of A position (VOE) to assess a beneficial borrower’s a position background.

Businesses are not expected to complete composed VOE forms out of lenders as part of the employment confirmation process, but the majority get it done because it masters team. Companies need written concur from team ahead of taking authored confirmation.

Earnings Confirmation Techniques

Our home to invest in procedure has many methods, nevertheless chief a person is financial underwriting where in fact the lender analyzes a great borrower’s capacity to spend. The initial investigations is automated and reviewed predicated on records registered. They is designed to be sure particular facts and talks about three main areas:

- Credit: Your credit score reflects any foreclosure or bankruptcies, the latest position out-of rotating fund and you can any unpaid expense.

- Capacity: Potential focuses on your debt-to-income ratio (DTI), which is talked about less than in detail and you may reveals if you have a workable level of financial obligation.

- Collateral: Collateral examines your downpayment matter additionally the possessions youre looking to buy to see exactly what chance your pose off defaulting.

Main to any or all ones assessments can be your work history having the brand new preceding a couple of years. To have salaried borrowers, that it work confirmation is carried out compliment of spend stubs, tax statements and you will W2s. Getting care about-operating borrowers, record is lengthened and you may is sold with taxation statements and you can 1099 forms and profit-and-loss comments. These types of financial desires all are mortgage criteria, as well as financial statements.

This process to verify money Fort Morgan loans are initial finished of the machines and spends automated underwriting possibilities. It will introduces warning flags otherwise parts looking for much more information. Yet, manual underwriters dominate to research the information and ask for most income confirmation data files.

Created Confirmation out-of A job (VOE) Explained

When W2 income information to have salaried group provided with W2s try decreased, lenders tend to request a created VOE within the a position verification procedure. In the place of W2s, shell out stubs and you can tax forms, so it have to be complete by the a recently available otherwise earlier in the day employer.

New authored VOE, otherwise Fannie mae VOE Form 1005, includes information about big date out of get, cancellation time (in the event the applicable), compensation and compensation construction (bonuses, commissions). It might likewise incorporate information regarding the chances of proceeded a position if a career condition is an issue, date and you will number of 2nd shell out increase, and you will reasons for leaving. If it more details is offered, it ought to be thought to be a portion of the income and you will a job study.

This new file should be computer system generated otherwise typed because of the borrower’s manager. It could be filled out of the Time agencies, group work environment, payroll department, outside payroll vendor, otherwise an effective borrower’s newest or former manager. Self-functioning individuals avoid the use of a composed VOE and you can rather bring taxation data to ensure earnings.

- Онлайн казино Ирвин. Зеркало казино Irwin. Личный кабинет, регистрация, игровые автоматы

- Играть Бесплатно В Misery Mining На Аркада Казино

- Банда казино играть на деньги! Мобильная версия доступна уже!

- Банда казино регистрация

- Spatial Pornography The ongoing future of VR Pornography in the funny 2024?

- The full time when dating sites was basically booked towards the more youthful try over

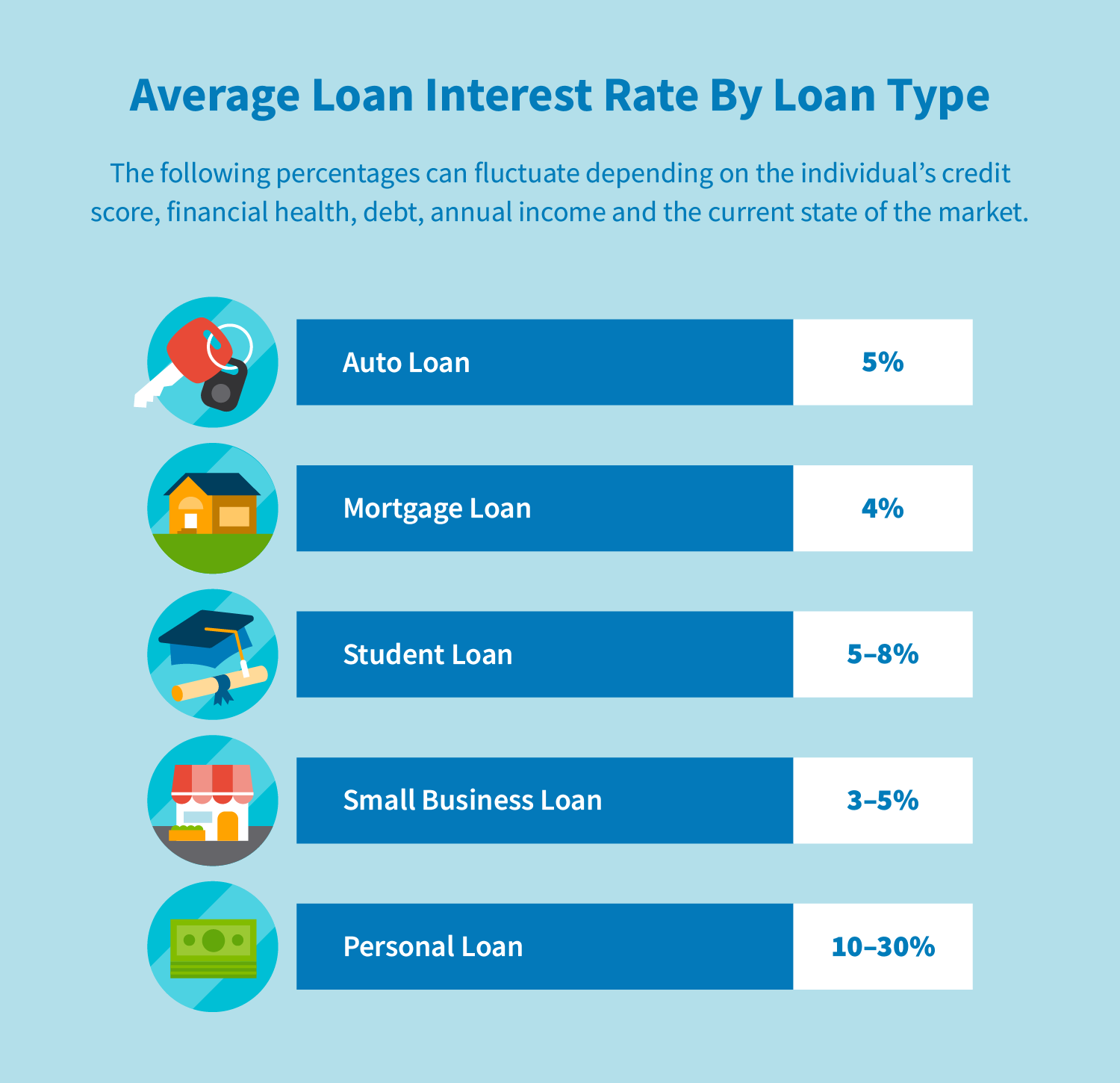

- Mortgage Conditions getting a low Credit history

- Why you should Imagine Refinancing Your residence

- Как наслаждаться игровым заведением в Интернете БетВиннер официальный сайт вход Игровые автоматы За деньги