Mortgage lenders offered loan applications could possibly get reason for a third dimension, called side-avoid DTI

In this post:

- How come Loans-to-Money Proportion Functions?

- What Would be to My Debt-to-Income Proportion Getting?

- Debt-to-Earnings Proportion and Mortgage loans

- Do Debt-to-Earnings Proportion Apply at Your credit rating?

- How can i Improve My Debt-to-Money Ratio?

Loan providers provides different definitions of your ideal debt-to-income ratio (DTI)-the portion of their terrible monthly income familiar with pay expense-but most of the concur that a lesser DTI is the most suitable, and a beneficial DTI that is excessive can be container a credit card applicatoin.

Loan providers have fun with DTI determine your capability to take on even more personal debt nonetheless match all your valuable money-specifically those towards financing they are offered providing you with. Once you understand the DTI proportion and you will exactly what it way to loan providers normally make it easier to know very well what version of finance youre probably to help you be eligible for.

Why does Personal debt-to-Money Ratio Performs?

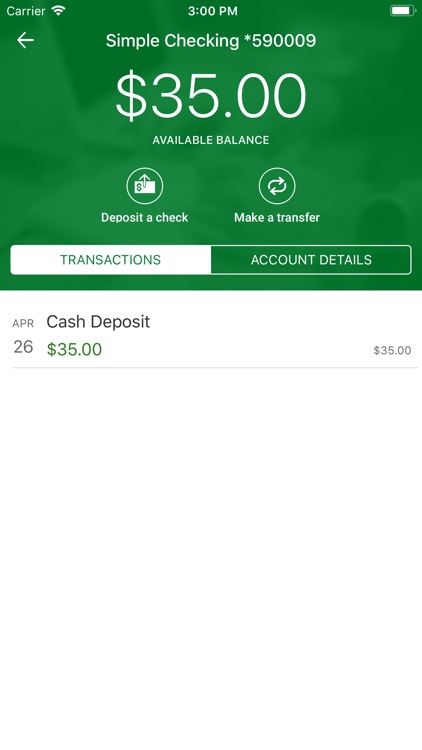

To estimate your DTI ratio, make sense their repeating month-to-month obligations repayments (also charge card, student loan, home loan, car finance and other financing payments) and divide the sum by the gross month-to-month money (the quantity you will be making every month prior to fees, withholdings and you may expenditures).

Should your complete monthly expenses because listed above was $dos,3 hundred and your terrible monthly money was $5,two hundred, the DTI proportion could well be $dos,three hundred split up by $5,2 hundred, otherwise 0.49. DTI is oftentimes indicated just like the a percentage, therefore multiply because of the 100 to find 44%.

Most lenders use this figure, both named the back-end DTI, along with your credit rating to evaluate their creditworthiness.

This is basically the portion of your gross income you to definitely would go to homes can cost you-lease otherwise home loan repayments, property taxes, homeowners insurance, condominium otherwise home owners organization costs, and the like. Bringing a different go through the example above, whether your property costs are $step one,150 as well as your gross monthly earnings try $5,2 hundred, your own front side-stop DTI would-be $step one,150 split up from the $5,200, or twenty-two%.

Exactly what Will be My personal Debt-to-Income Ratio Become?

There isn’t any “perfect” DTI ratio that most loan providers need, however, lenders usually agree less DTI is perfect. According to proportions and kind out of mortgage they might be giving, loan providers put their particular limits about how precisely lowest the DTI must end up being for mortgage approval.

Debt-to-Income Ratio and you can Mortgages

Your DTI proportion was a primary cause of the mortgage approval techniques. There are numerous types of mortgage loans, and every features its own DTI criteria. Understanding your DTI proportion can help you narrow down that could end up being good for you.

Conventional Mortgages

A traditional home loan otherwise mortgage is a type of financing that’s not supported by the us government and is given to the fresh new debtor right from a lender, borrowing from the bank union otherwise mortgage lender. Traditional loans also are also known as compliant loans because they satisfy the needs for purchase because of the Fannie mae and Freddie Mac computer, the federal government-paid companies you money to loan Cowarts, AL to get almost all unmarried-home mortgages and you may package all of them on ties which might be replaced including carries. These money want borrowers having back-end DTI ratios below 43%, some lenders like DTI percentages no higher than 36%. Getting individuals with high fico scores and you can enough assets or other money present (along also known as “compensating issues”), maximum DTI on the a conforming financing is really as large because the fifty%.

Strange Mortgages

An unusual financial or financial is actually a loan supported by a government institution for instance the Federal Homes Organization (FHA) or perhaps the Experts Administration (VA). When evaluating apps to possess bizarre mortgage loans, loan providers pursue FHA recommendations that allow them to envision each other front side-end and you will right back-avoid DTI percentages.

FHA direction need side-prevent DTI rates from no more than 30% otherwise straight back-avoid DTI rates no more than 43%, however, permit large DTIs lower than specific things. As an instance, applicants which have straight back-stop DTIs as much as 50% can get be eligible for FHA financing if the fico scores is actually greater than simply 580 and they offer reported proof of the means to access cash supplies or more income source.

- Онлайн казино Ирвин. Зеркало казино Irwin. Личный кабинет, регистрация, игровые автоматы

- Играть Бесплатно В Misery Mining На Аркада Казино

- Банда казино играть на деньги! Мобильная версия доступна уже!

- Банда казино регистрация

- When Does Your spouse Have to Sign Mortgage Documents to possess a beneficial Providers Financing otherwise Personal Guarantee?

- Mississippi Household Organization’s Smart6 loan is actually a 30-year fixed-rates financial to possess qualified earliest-some time and repeat homeowners

- Chinese cam room designed for singles

- Официальный сайт Вавада казино особенности и преимущества платформы

- They earnestly supported the brand new NATO-added operation for the Afghanistan off 2010 and given help to the follow-on mission